Uniswap is not exactly unknown in the crypto world. Therefore, it is not possible to ignore the news that the United States Securities and Exchange Commission (SEC) has opened an investigation Uniswap Labs, the developer behind the largest decentralized exchange along with PancakeSwap, Uniswap. What has happened to UNI? In Café con Criptos We give you all the details.

SEC investigation of UniSwap

Decentralized exchange giant Uniswap Labs will face an investigation from the United States Securities Commission, according to a report published by the Wall Street Journal (and collected by Crypto Briefing) on Friday morning. According to anonymous sources, SEC attorneys are seeking information on how investors use Uniswap and how the exchange is traded.

In response, a representative from Uniswap Labs has stated the following to the Wall Street Journal:

"[Uniswap is] committed to complying with the laws and regulations that govern our industry and providing information to regulators to assist them in any investigation.

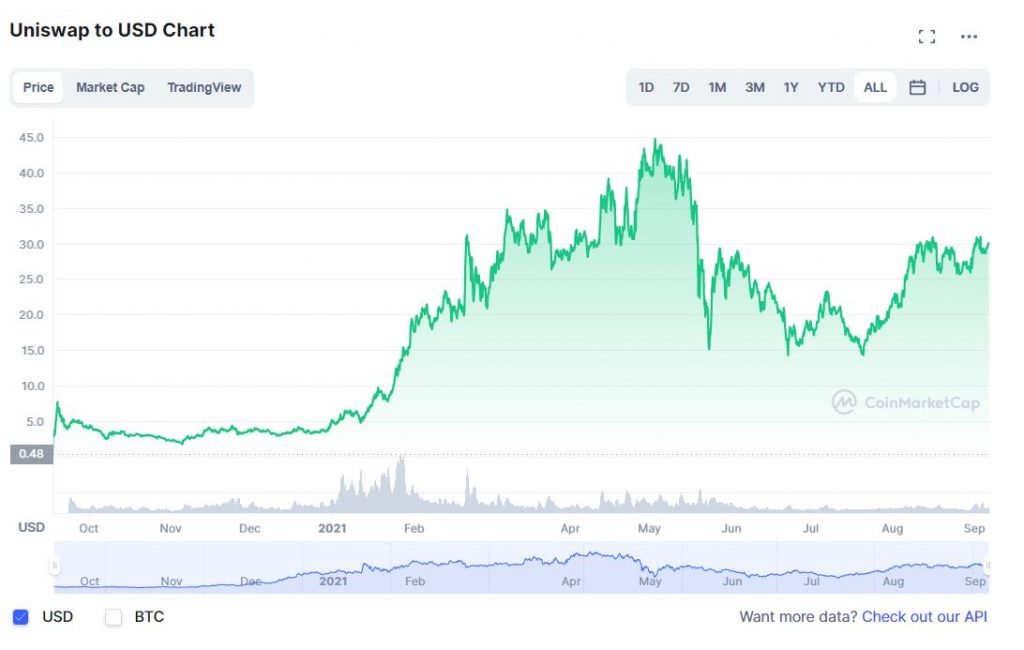

The exchange's governance token, UNI, has reacted negatively to the news, falling more than 6% so far, although its price remains at $ 30 on the morning of Monday, September 6, 2021. However, Uniswap Labs' research appears to be in its early stages and may not produce any formal charges of infringement.

Gary Gensler vs the DeFi

SEC Chairman Gary Gensler has frequently expressed concern about the lack of regulation of decentralized finance since he was appointed director of the organization in April.

Previously, Gensler commented on the worrying trend towards "gamification" of investments, citing apps like Robinhood as drivers of the "meme stock" phenomenon earlier this year (with GameStop and AMC being the main exponents of the explosion).

Since researchers are supposedly interested in how Uniswap is marketed, it is possible that Gensler is also approaching the issue from a gamification perspective.

Is Decentralized Finance Safe?

Earlier this week, Gensler reiterated his stance on DeFi protocols, stating that many supposedly decentralized platforms have "a fair amount of centralization," citing governance mechanisms, fee models, and incentive systems.

The SEC has become increasingly involved in regulating the cryptocurrency space. Following the evolution of the regulator's ongoing case against Ripple, the SEC has also sued BitConnect founder Satish Kumbhani this week in new legal filing.

Uniswap, concerned for your safety

Uniswap Labs has not stood idly by in the face of mounting regulatory pressure. In July, the exchange delisted more than 100 tokens, which raised doubts about the decentralization of the platform. Many of the withdrawn tokens were synthetic assets or tokenized stocks, instruments with a high risk of being classified as securities by the SEC.

Uniswap has grown exponentially since its V1 release in November 2018. In August, the protocol facilitated more than $ 53.000 billion in trading volume, with users locking up $ 5.200 billion worth of assets to provide liquidity.