da Mai Kirkirar Mai sarrafa kansa (Masu yin Kasuwa ta atomatik ko AMM) sun zama wani muhimmin sashi na yanayin yanayin DeFi, sauƙaƙe tiriliyan a cikin adadin ciniki. Ƙaddamar da ayyuka kamar Bancor da Uniswap a cikin 2017/2018, AMMs suna ba da wani zaɓi mai ban sha'awa ga tsarin littafin ƙayyadaddun iyaka na gargajiya.

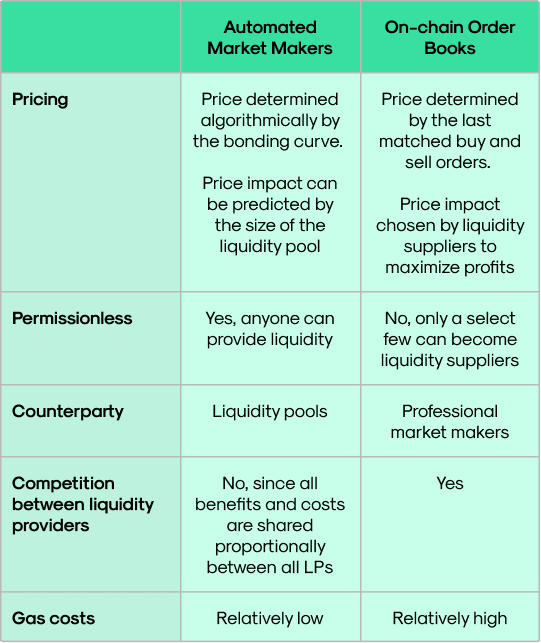

La kwafi na littafin oda akan blockchain kuna fuskantar manyan matsaloli guda biyu: na farko, akwai farashin iskar gas ga kowane oda cewa mai yin yana son aikawa ko canza, wanda ya zama mai tsada a kan lokaci kuma ba ya aiki. Na biyu, tunda bayanan blockchain yana samuwa a bainar jama'a kuma ana iya samun sauƙin shiga, da gaba-gaba yana hana 'yan kasuwa aiwatar da kasuwancin da suke so da gaske.

Daya daga cikin manyan abũbuwan amfãni daga MMAs game da oda littattafai shi ne kowa zai iya ba da dukiya zuwa biyu don zama mai samar da ruwa kuma su sami kuɗin ciniki. Saboda, AMMs na iya jawo ƙarin jari, yana haifar da zurfin zurfin kasuwa don musayar ra'ayi (DEXs) idan aka kwatanta da takwarorinsu na tsakiya. Don haka ba abin mamaki ba ne cewa wannan ƙirƙira ta zama muhimmin tushe ga mafi mashahuri DEXs har ma da sauran aikace-aikacen DeFi.

Takaitaccen tarihin MMA

Wanda ya kafa Ethereum Vitalik Buterin da farko sun tattauna aikin DEX akan blockchain tare da AMM a cikin 2016, wanda daga baya wahayi zuwa ga halittar Uniswap.

Ko da yake Bancor an lasafta shi da ƙirƙirar AMM na farko (wanda ake kira omnipool), ɗaya daga cikin manyan abubuwan da ke tattare da wannan hanya shine. Dole ne a haɗa alamomin tare da alamar BNT ta asali. Tun da an yi amfani da wannan alamar azaman maƙasudin gama gari a cikin duk wuraren tafki, duk musayar ya buƙaci alamar BNT. A sakamakon haka, yan kasuwa sun sami raguwa sau biyu idan suna so su canza daga USDC zuwa ETH (tunda hanyar gaba ɗaya shine: USDC zuwa BNT, sannan BNT zuwa ETH).

Ta hanyar kawar da buƙatar alamar hanyar sadarwa don yin musayar kamar a Bancor, Ayyukan Uniswap sun dogara gaba ɗaya akan ajiyar token a cikin tafkin ruwa, godiya ga tsari mai sauƙi amma kyakkyawa: x*y = ku wanda ya canza DeFi. Nasarar Uniswap tun lokacin da aka ƙaddamar da shi a cikin Nuwamba 2018 a ƙarshe ya haifar da ƙirƙirar ɗimbin nau'ikan DEX na tushen AMM kuma ya nuna cewa AMMs sun yi babban alkawari a matsayin sabon kudi na farko.

Kodayake Uniswap ya sami babban ci gaba tare da aiwatarwa biyu na farko, tun ana samar da ruwa daidai gwargwado farashin daga sifili zuwa mara iyaka, rashin wadatar jari. An warware wannan matsala tare da gabatarwar Matsakaicin yawan ruwa a cikin Uniswap v3, inda aka inganta aikin jari sosai, wanda ya haifar da yawan kuɗi da ƙarancin zamewa.

Ga LPs, yana rage haɗarin asara saboda ana samar da ruwa a cikin kewayon farashin. Wani yanayin da ya dace na tattara ruwa mai yawa shine sauƙi da sassaucin da yake ba da izini, tare da Uniswap v3 yana iya ɗaukar sifar kowane mai yiwuwa AMM.

Yanzu da muka san kadan game da asalin MMAs, bari mu ga yadda suke aiki.

MMA yayi bayani mataki-mataki

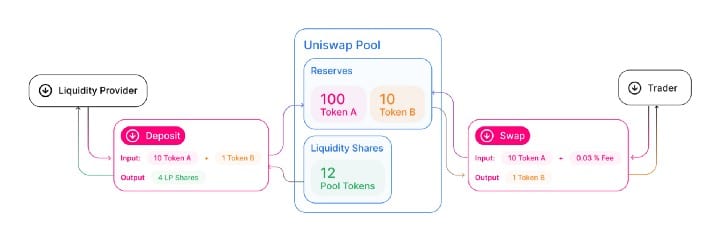

Don sauƙaƙe ciniki, AMM maye gurbin littattafan oda tare da wuraren waha na ruwa. A liquidity pool ne m kwangila mai kaifin basira wanda ke riƙe da ajiyar alamomi daban-daban guda biyu a cikin wani rabo na musamman. Lambar kwangilar wayo ta ƙayyadad da yadda ajiyar kuɗi ke ƙayyade farashin, ka'idodin samar da ruwa da ciniki, da kuma kuɗin da 'yan kasuwa ke jawowa yayin musayar ta cikin tafkin.

da masu samar da ruwa (nan gaba LP) na iya samar da kadarorin crypto zuwa wurin ajiyar ruwa don samun kuɗin ciniki daga kowace ma'amala da sami lada don samar da ruwa zuwa wani tafkin musamman. Ana ba da kyaututtuka na Token yawanci a cikin alamar gudanarwa na yarjejeniya, yana baiwa masu riƙe da haƙƙin kada kuri'a kan haɓaka ƙa'idar da AMM.

Don ci gaba da lura da rabon kuɗin da LP zai karɓa, ana ƙididdige hannun jari a matsayin alamun LP. daidai da gudunmawar kuɗin ku a matsayin wani yanki na jimlar tafkin. Wannan yana nufin idan LP ya ba da kashi 10 cikin 10 na kadarorin, za su sami kashi XNUMX cikin XNUMX na kuɗin ciniki da tafkin ke samarwa. Ana iya ƙone alamun LP waɗanda ke wakiltar matsayin ku a kowane lokaci don cire ruwa daga tafkin.

Babban bidi'a na MMAs akan tsarin littafin tsari shine kowa zai iya samar da kudin ruwa da samun rabon kuɗin ciniki, wanda ke rage shingen shiga. A cikin tsarin littafin tsari na tsakiya, aikin LP yawanci ana keɓance shi don zaɓaɓɓun ƴan mutane ko kamfanoni masu daraja. Tare da zuwan MMA, wannan fasalin yana buɗewa har zuwa manyan masu sauraro.

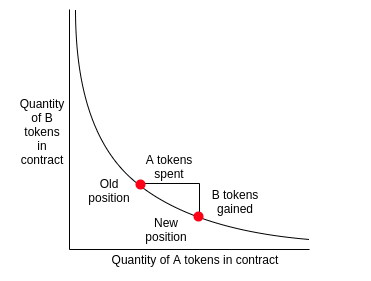

Ta fuskar dan kasuwa, fa’idar ita ce zaka iya samun kudin ruwa nan take lokacin yin hulɗa tare da tafkin, kuma babu buƙatar jira umarnin da ya dace. Idan mai ciniki yana so ya saya ko sayar da alamar, zai iya zuwa tafkin, ya ƙayyade kadarar da adadin da yake so ya yi ciniki. The smart contract to zai samar da farashin musanya bisa la'akarin peg, wanda aka ƙididdige shi bisa ga tanadi na alamomin daban-daban guda biyu a cikin tafkin.

A matsayin misali, la'akari da tafkin don ETH-USDC tare da tanadi masu zuwa: ETH = 1 da USDC = 500. Biyan samfurin Uniswap v000, farashin AMM daidai yake da rabon ajiyar kuɗi (10 USDC). Da zarar dan kasuwa ya sayi 000 ETH tare da $2 a cikin USDC, AMM ta cire 150 ETH daga tafkin kuma ta ƙididdige waɗannan alamun zuwa walat ɗin ɗan kasuwa. Hakanan AMM yana ƙara 1 USDC na ɗan kasuwa zuwa tafkin. Dangane da ma'aunin kuɗin, wanda aka saita kuma aka ƙididdige shi ta hanyar kwangilar wayo, za a caje ɗan kasuwa wani kaso na ma'amalarku.

Bayan an aiwatar da cinikin, za a sami ƙarancin ETH a cikin tafkin da ɗan ƙaramin USDC. Tun da peg curve algorithmically yana ƙayyade farashin ETH a matsayin rabon adadin kadari, Farashin ETH ya faɗi ya kai 147 US dollar. Idan mai ciniki ya sayar da ETH don USDC, to, rabon zai motsa a cikin kishiyar shugabanci kuma ya haifar da karuwa a farashin ETH.

Don girman girman ciniki, bambanci tsakanin farashin tabo da farashin da aka gane (wanda kuma aka sani da zamewa) yana ƙaruwa yayin da adadin alamun da aka yi ciniki yana ƙaruwa dangane da girman tafkin. Saboda haka, AMMs suna tilasta waɗanda ke shiga manyan ma'amaloli don biyan farashi mafi girma idan aka kwatanta da ƙananan ma'amaloli. Don haka, dole ne a saita takamaiman haƙurin zamewa don aiwatar da umarni.

Lokacin da ciniki ya faru wanda ke sa farashin da ƙungiyar ta faɗi ya karkata sosai daga ƙimar kasuwa mafi girma, masu sasantawa za su iya shiga tsakani su gyara tafkin ya yi yawa don amfana daga bambancin farashi a cikin AMM da sauran wuraren kasuwanci.

Alal misali, idan babban sayar da ETH ya sa farashin ya ragu daga 150 USDC zuwa 135 USDC, amma matsakaicin kasuwa ya kasance kusa da 150 USDC, to, masu sulhu na iya siyan ETH daga AMM kuma su ci gaba da sayar da shi a wasu wuraren kasuwanci. . Kamar yadda masu sasantawa suka sayi ƙarin ETH ta hanyar AMM kuma ana cire ƙarin ETH daga tafkin ruwa, a ƙarshe farashin zai haɗu da farashin kasuwa da 150 USD.

Kamar yadda muka gani a baya. duk wani musanya yana canza abun da ke cikin kadarorin tafkin kuma ana sabunta kuɗin musanya ta atomatik, yana canza ƙimar duka ƙungiyar. Kamar yadda farashin wani kadara ke jujjuyawa, haka darajar tafkin ke canzawa, ma'ana darajar kuɗaɗen tafkin LP kuma tana canzawa. Da kyau, LP yana so ya cire ruwa a kusa da farashin da suka shiga matsayi kamar yadda zai yiwu, saboda suna iya haifar da hasara lokacin da aka janye kadarorin daga tafkin bayan canjin farashin, wanda aka sani da suna. asara. Koyaya, asarar da ba ta dawwama za a iya biya ta kudade da ladan alamar da LP ta samu.

MMA a cikin aiki

A cikin wannan sashe, zamu bincika shahararrun samfuran AMM guda uku don haskaka hanyoyi daban-daban: Baza, kwana y Balaguro.

Baza

Akwai nau'ikan MMA daban-daban tare da daban-daban lankwasa kayayyaki na Union.

Samfurin Maƙerin Kasuwar Ƙi-da-kai yana daidaita farashi ta hanyar kiyaye samfurin lissafi na adadin kadarorin biyu akai-akai. Misali, nau'ikan Uniswap 1 da 2 an san su da CPMMs, inda yawancin adadin alamomin daban-daban ke gudana akai-akai bisa ga dabara mai zuwa:

[haske] x * y = k[/ haskakawa]Inda x shine adadin alama ɗaya (misali ETH), y shine adadin wata alama (misali USDC), kuma k shine dindindin.

A cikin v2, kwangilar wayo ta ƙungiyar ta ɗauka cewa ajiyar kadarorin biyu suna da ƙima ɗaya. Don haka LP zai samar da ETH da USDC a cikin rabo na 50:50 zuwa tafkin don kiyaye k akai-akai.

A cikin v3, Ana iya tattara tanadin ruwa a cikin wani yanki na lanƙwasa na bonds, rage zamewa da kuma inganta babban jari yadda ya dace. LPs a cikin v2 za su ba da ƙima a duk faɗin ƙimar ƙimar haɗin gwiwa, ma'ana yawancin ruwa ba a cinyewa. Tare da haɓakar ƙima, LPs na iya zaɓar kewayon da za su samar da ruwa kuma za su iya daidaita matsayinsu dangane da yanayin kasuwa.

Saboda haka, Uniswap v3 yana motsawa daga ƙirar samfur akai-akai, Haɗe wannan samfurin tare da mai ƙididdige yawan adadin kasuwa. Ba a yin ayyuka tare da madaidaicin mataki ɗaya da aka ƙaddara ta hanyar equation x * y = k, kamar yadda a cikin sigogin baya. Liquidity na iya dainawa, ma'ana kowane matsayi na LP ana iya zubar da shi daga tafkin guda ɗaya, wanda ba zai iya faruwa tare da v1/v2.

kwana

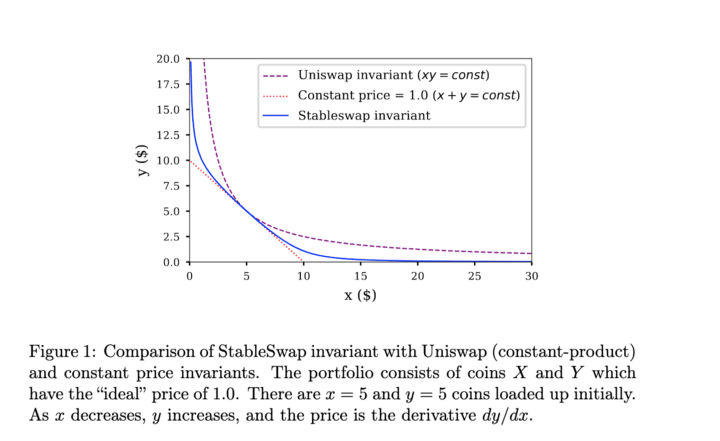

Curve misali ne na Haɓakar Haɓaka MMA, wanda ya haɗu da samfurin akai-akai da ƙididdiga na yau da kullum don samar da mai yin kasuwa mai sarrafa kansa wanda ya fi dacewa don kasuwancin stablecoin.

A Curve v1 liquidity pool ya ƙunshi kadarori biyu ko fiye masu alaƙa iri ɗaya, kamar USDC da DAI, WBTC da renBTC, ko stETH da ETH. Stablecoins sun ga karuwa mai yawa a cikin tallafi, Curve ya zama DEX tare da mafi girman jimlar ƙimar kullewa, yana sauƙaƙe kasuwancin barga tare da ƙananan kudade da zamewa.

Yayin da kadarorin da ke cikin tafki suka zama marasa daidaituwa, lanƙwan peg ɗin yana ɗaukar sifar daɗaɗɗen fitarwa (mai kama da Uniswap v1/v2). Duk da haka, lokacin da aka ba da kadarori kamar yadda kuɗin musanya ya kusa isa ga daidaito, tsarin haɗin gwiwa yana canzawa zuwa ƙirar ƙididdiga akai-akai:

Amfanin tsarin jimla na dindindin shine cewa yana kawar da zamewar da aka samu a cikin samfuran samfuran akai-akai. Samfurin matasan da Curve ke amfani da shi an kwatanta shi da 'stableswap mai canzawa' a cikin wannan adadi:

A cikin Curve v2, da ana sabunta ma'aunin farashi koyaushe bisa ga baka ginshiƙi farashin ciki don mafi kyawun wakilcin farashin kasuwa da tabbatar da cewa ciniki ya tsaya kusa da karye-ko da. Za a iya siffanta fasalin mai yin kasuwa a kowane farashi, wanda ya dace da duk alamu maimakon stablecoins ko kadarorin da ake siyar da su tare.

Balaguro

The balancer yarjejeniya yana ba da damar kowane tafkin don samun fiye da kadarori biyu kuma a ba su a kowane rabo. Kowane tafkin kadari an sanya ma'aunin nauyi a cikin samar da ruwa inda jimlar ma'aunin nauyi daidai yake da 1, inda ma'aunin nauyi ba sa canzawa tare da samarwa ko cire ruwa, amma a maimakon haka yana wakiltar ƙimar tafkin a matsayin ɗan juzu'in ƙimar ƙimar. kungiyar.

Ma'auni yana haɓaka manufar samfurin akai-akai da Uniswap ke amfani da shi zuwa ma'anar lissafi, yana haifar da abin da ake kira Maƙerin Kasuwa na dindindin. Wannan samfurin kuma yana ƙara wani ɗan wasa a cikin MMA ban da LPs da 'yan kasuwa, waɗanda aka sani da masu sarrafawa, waɗanda ke da alhakin sarrafa ƙungiya.

[haske] x ^ (0,2) + y^ (0,3) + z^(0,5) = k[/ haskakawa]Tare da wuraren waha mai wayo na Balancer waɗanda ke amfani da matsakaicin matsakaici (kamar wanda aka nuna a sama), za mu iya haifar da liquidity wuraren waha tare da har zuwa takwas alamomi, kyale don ƙarin keɓancewa.

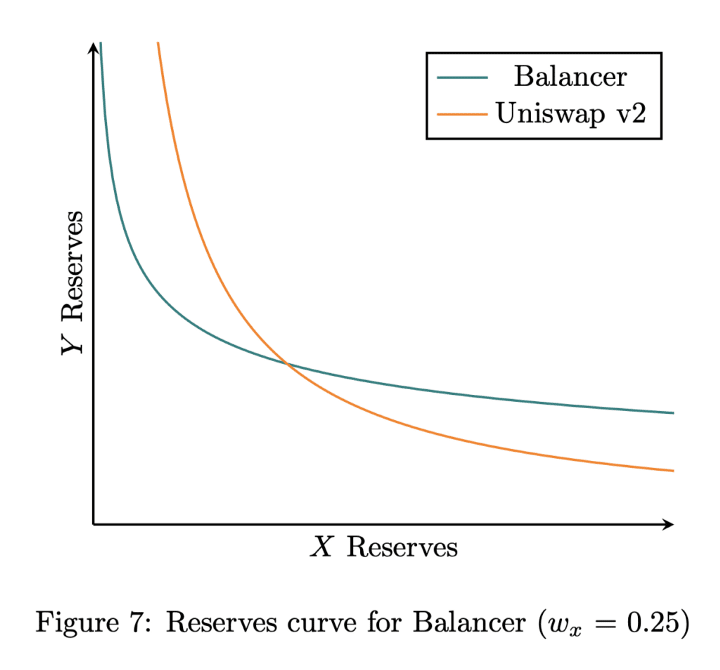

Don haka, kuɗaɗen Balancer kamar kuɗaɗen ƙididdiga ne waɗanda ke gina tarin kadarori tare da ƙayyadaddun ma'auni. Hoton da ke ƙasa yana kwatanta lanƙwan da Balancer ke amfani da shi tare da kadarori biyu (ɗaya mai nauyi a 25% ɗayan kuma a 75%) idan aka kwatanta da lanƙwan Uniswap v2.

Alal misali, za mu iya ƙayyade kowane nau'i don tafkin bullish ko bearish. Ƙungiya mai mahimmanci don ETH-USDC za a iya ƙirƙira ta hanyar ƙayyade nauyin 90% don ETH da 10% don USDC. A madadin, ana iya ƙaddamar da tafkin bearish ta yin akasin haka.

Sauran AMM DeFi Aikace-aikace

DEXs shari'a ce ta amfani guda ɗaya ta amfani da AMM algorithm, wanda kuma ya samar da tushen wasu aikace-aikace a cikin DeFi.

Babban misali shine Tafkunan Bootstrapping Liquidity (LBP) daga Balancer. Ana amfani da LBPs don fitowar alamar gaskiya, kasancewa Yarjejeniyar Tsarewa aikin farko a ciki yi shi da alamar $PERP. Ba kamar MMAs ɗin da muka bincika ya zuwa yanzu, Za a iya canza ma'auni na pool. An saita tafki na alamu biyu tare da alamar aikin, kamar PERP, da alamar lamuni, kamar USDC.

Da farko yana saita ma'auni don goyon bayan alamar aikin, sannan a hankali ya canza don fifita alamar lamuni a ƙarshen siyarwa. Ana iya daidaita tallace-tallace na Token ta yadda farashin ya ragu zuwa mafi ƙarancin da ake so. Ta wannan hanyar, ana amfani da AMM don yin aiki irin na gwanjo, inda masu sayan farko za su biya farashi mai yawa, kuma bayan lokaci, farashin alamar aikin zai ragu har sai an kammala rabon.

Za mu iya samun misalai masu kyau na aikace-aikacen MMA a cikin DeFi a wajen DEX a lamuni na atomatik, tare da ayyuka kamar Kuɗi na Notional y Yarjejeniyar Haɓakawa. Duk ayyukan biyu suna sauƙaƙe ƙayyadaddun ƙima, ƙayyadaddun rancen kadari na crypto da bada lamuni tare da madaidaicin madaurin jimlar ƙarfin.

AMMs a cikin waɗannan lokuta an ƙirƙira su don kasuwanci da alamun ERC-20 kama da sifili na takaddun shaida waɗanda za'a iya fansa don ƙaƙƙarfan kadari a takamaiman kwanan wata na gaba. Matsakaicin adadin wutar lantarki akai-akai yana haɗa lokacin ƙarewa cikin farashi, yana bawa masu amfani damar yin ciniki bisa ƙimar riba maimakon farashi.

MMA su ɗaya daga cikin ƙayyadaddun sabbin abubuwa don fitowa daga sararin DeFi kuma sun haifar da ƙirƙira nau'ikan aikace-aikacen da ba a daidaita su ba, gami da DEXs da lamuni ta atomatik. Bincike kan bambance-bambance daban-daban da ingantattun bambance-bambance har yanzu yana ci gaba (kamar TWAMM) yana ƙara faɗaɗa sararin ƙira da bayyanar sabon tsara na ladabi da aka kirkira tare da AMM.